From Our Blog

From Our Blog

Explaining Polymarket.com — How to build your own real-world events Prediction dApp (Polymarket Clone)

Oct 9, 2024

Prediction markets are gaining traction.

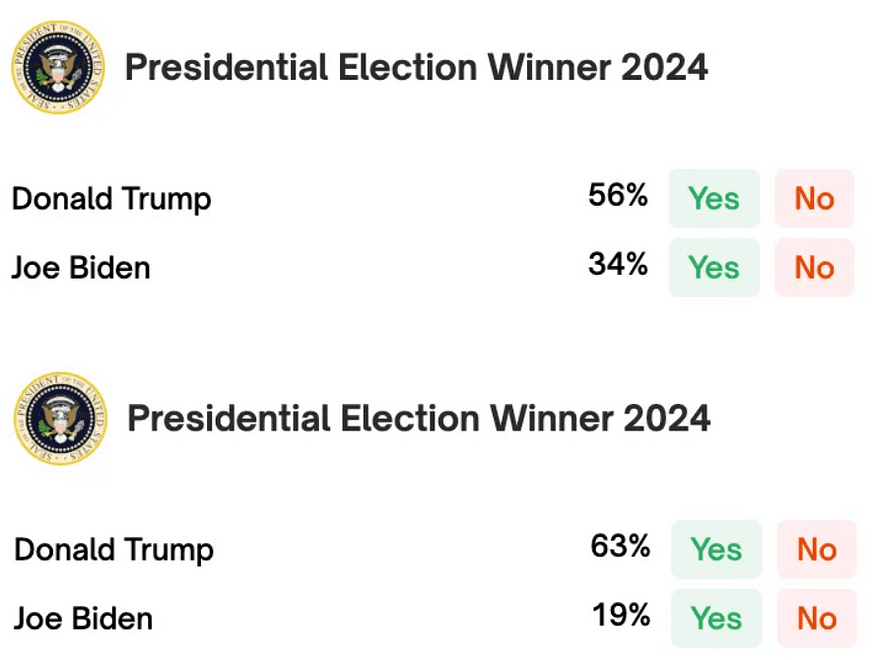

Platforms like Polymarket.com have shown that betting on real-world events can be lucrative and insightful.

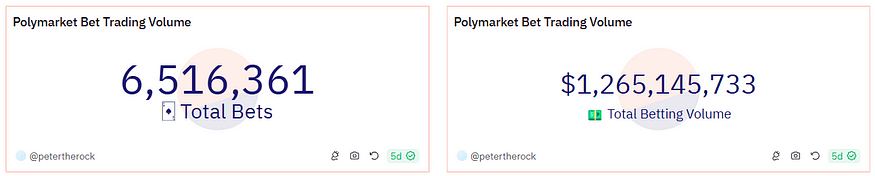

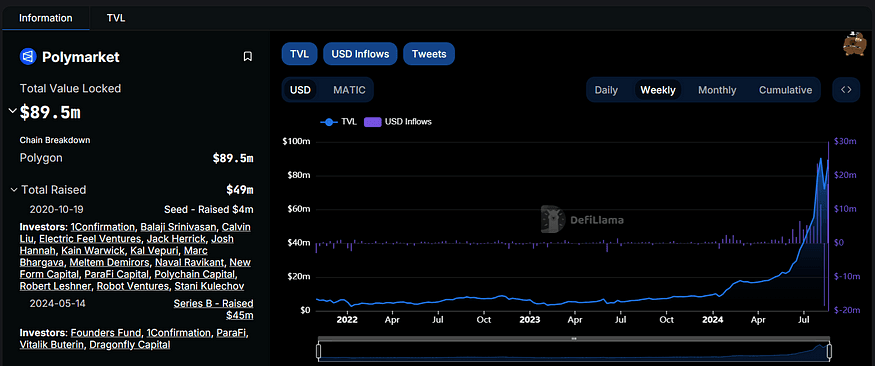

Polymarket, a leader in the space, boasts impressive numbers:

$1.26 billion in total betting volume

124,305 user accounts

$20.5 million in assets under management

These figures underscore the potential of prediction markets.

Want to build your own prediction market?

This guide will equip you with the knowledge to create a decentralized platform that allows users to trade on the outcome of future events.

How do Prediction Markets work?

Prediction markets are platforms where people trade on the outcome of future events. They use collective intelligence to forecast things like elections or economic trends.

How it Work

Trading Contracts: People buy and sell contracts linked to specific event outcomes. The contract’s price reflects the market’s belief in that outcome.

Trading Process: Most markets use a continuous double auction, where buyers and sellers match prices. To improve trading, some use automated market makers (AMMs) that always provide a trading partner.

Determining Winners: Once the event happens, the market decides who wins. This can be done using external data sources or community votes.

Types of Markets: There are markets that use real money, play money or blockchain technology.

The Role of Users

Traders and Creators: People can buy and sell contracts or create new markets.

Collective Wisdom: Many minds working together often make better predictions than individuals.

Rewards: Users are motivated by potential profits and sometimes extra rewards for helping the market.

Community and Learning: Users interact, share knowledge, and adapt their strategies based on market changes.

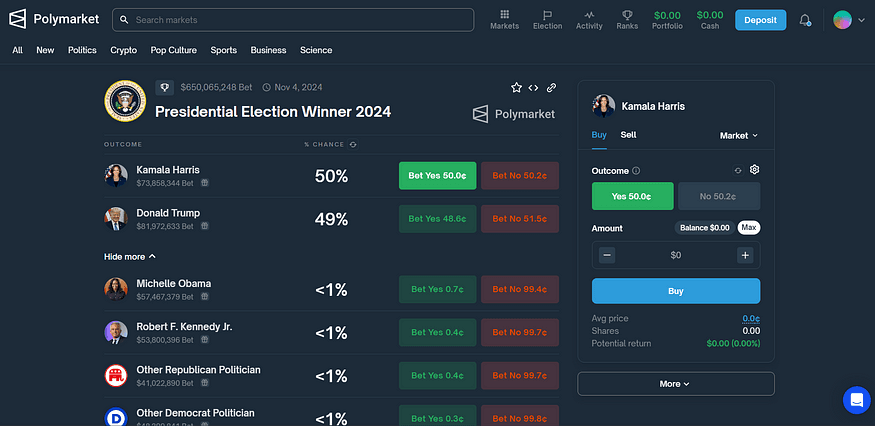

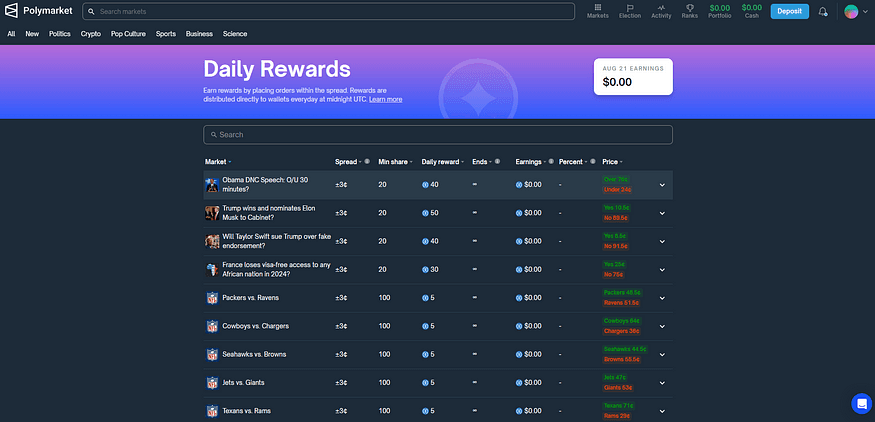

What is Polymarket?

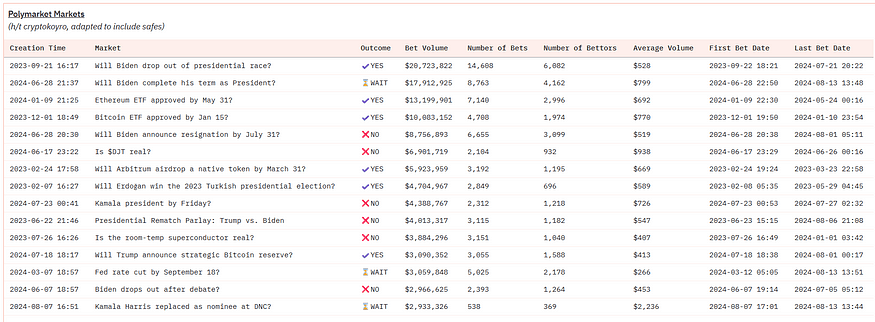

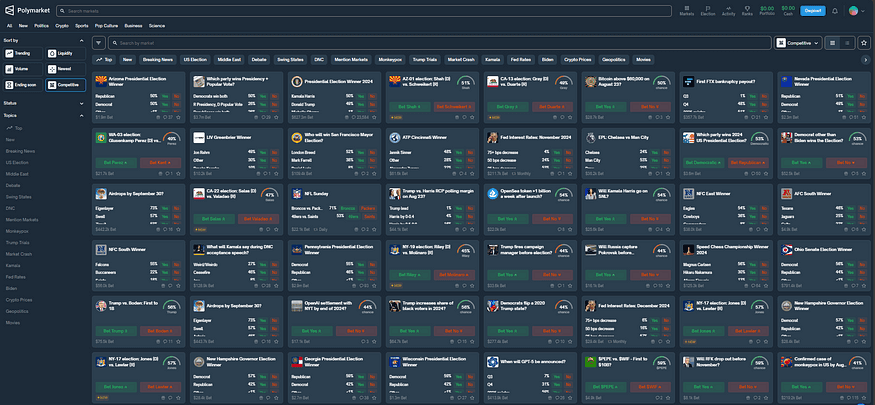

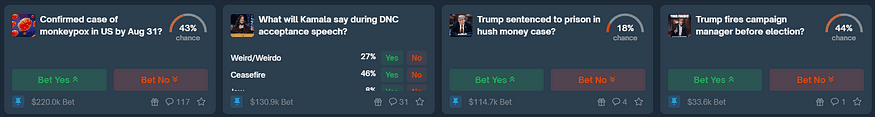

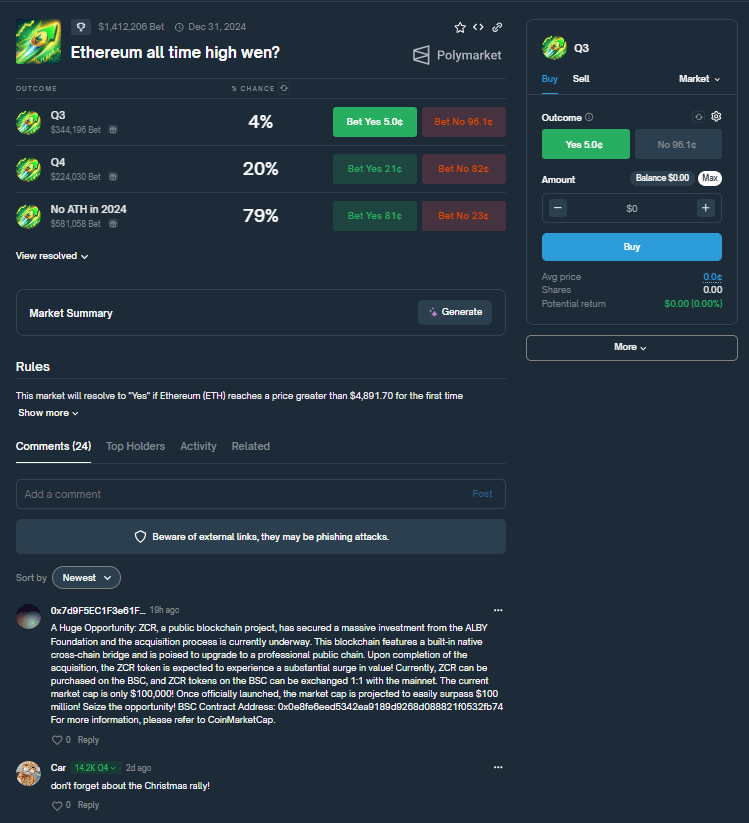

Polymarket is a platform where people can bet on the outcome of real-world events like Politics, Cryptocurrency, Sports, Science, Pop Culture, and Business using cryptocurrency. It runs on the Ethereum blockchain.

Key Features

Market Creation and Participation

Anyone can create a market on any event.

Users buy and sell shares based on their predictions about the event’s outcome.

Real-Time Odds

Market odds are displayed as dollar values.

Share prices reflect public opinion about the event’s likelihood.

Trading Flexibility

Users can set specific buy or sell prices (limit orders).

This allows for various trading strategies.

Community Focus

Users can interact and share information.

Enhances the overall platform experience.

Privacy and Accessibility

No need for traditional financial checks.

Protects user privacy.

How Does Polymarket Work?

User Interface

Design and Navigation

Clear Market Segmentation

Categorized Listings: Markets are grouped by themes like politics, sports, and finance for easy access.

Filter Options: Advanced filtering by event type, date, and popularity.

Dynamic Sorting: Markets are sortable by metrics like activity level and potential payout.

Streamlined User Dashboard

Unified Account View: Displays active bets, available funds, and historical performance in one place.

Customizable Widgets: Users can rearrange and customize dashboard elements for a personalized experience.

Real-Time Balance Updates: Balances are updated instantly with every transaction or market resolution.

Real-Time Updates

WebSocket Integration: Uses WebSocket for real-time updates without refreshing the page.

Asynchronous Data Loading: Ensures fast and smooth UI interaction, even with high data loads.

Instant Market Status Changes: Market statuses, odds, and other relevant data update live as events unfold.

Market Interaction

Direct Share Purchase

One-Click Transactions: Buy shares in a single click with instant confirmation.

Instant Odds Display: Odds are displayed in real-time before the purchase is finalized.

Transaction Transparency: All transaction details, including fees, are shown before finalizing the bet.

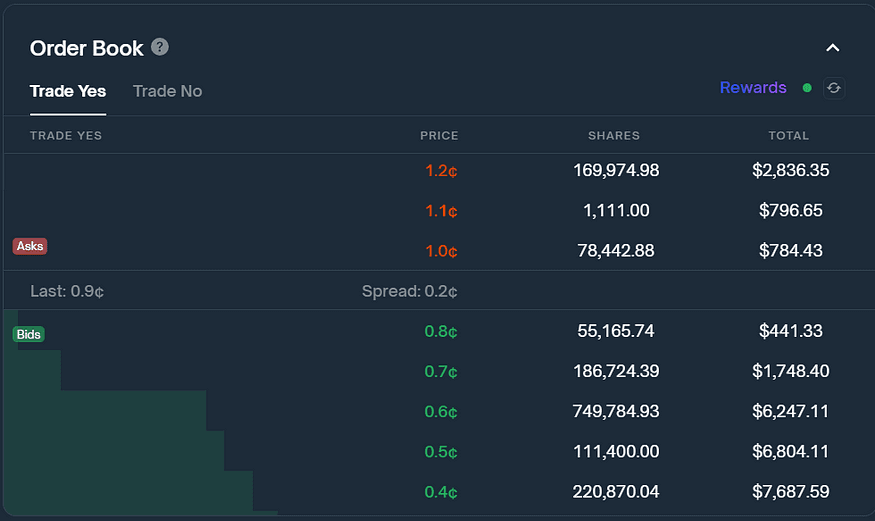

Customizable Limit Orders

Price Setting: Users can define the exact price at which they want to buy shares.

Order Persistence: Limit orders remain active until they are filled or canceled.

Order Matching Algorithm: Efficient matching of limit orders with existing market offers for optimal execution.

Instant Feedback on Transactions

Immediate Confirmation: Users receive instant feedback on the success or failure of transactions.

Live Order Tracking: Track the status of limit orders in real-time from the dashboard.

Error Handling: Detailed error messages if a transaction fails, with suggestions for resolution.

Cross-Device Compatibility

Mobile Optimization

Adaptive Layout: UI components rearrange based on screen size for optimal viewing on mobile.

Touch-Friendly Controls: Mobile-specific controls for easier navigation and interaction.

Offline Mode: Certain functionalities are available offline, with automatic sync when reconnected.

Adaptive UI Components

Responsive Grids: Grids and lists adapt to different screen resolutions for consistent visual structure.

Scalable Icons and Text: UI elements like icons and text scale appropriately across devices.

Browser Compatibility: Supports all major browsers to ensure consistent user experience.

Performance Optimization

Lazy Loading: Content is loaded progressively as needed to reduce initial load times.

Resource Caching: Frequently used resources are cached to minimize bandwidth usage and speed up load times.

Low-Latency Operations: Optimization techniques ensure minimal delay in user actions across all devices.

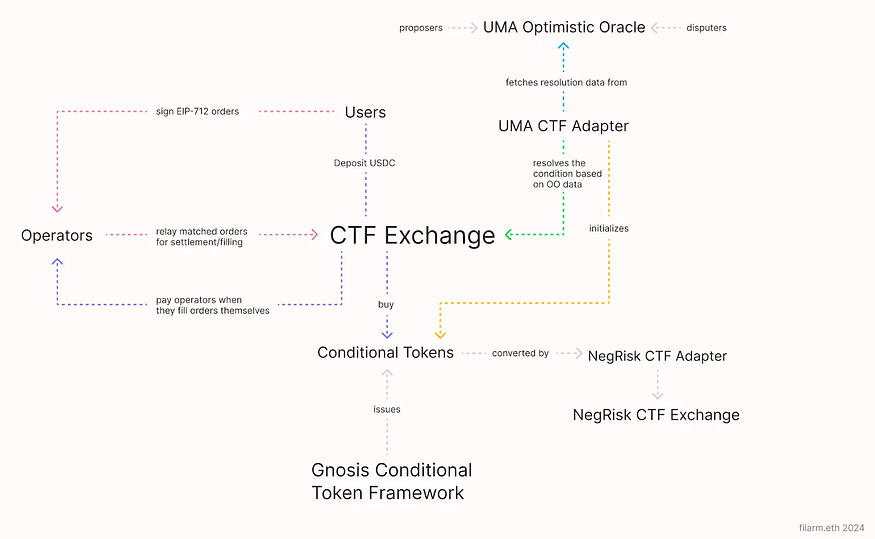

Backend Mechanics

Blockchain Infrastructure

Ethereum Mainnet

Security: Transactions are secured by Ethereum’s proof-of-stake (PoS) consensus mechanism.

Decentralization: Operates on a decentralized network, reducing single points of failure.

Interoperability: Compatible with other Ethereum-based DeFi applications and services.

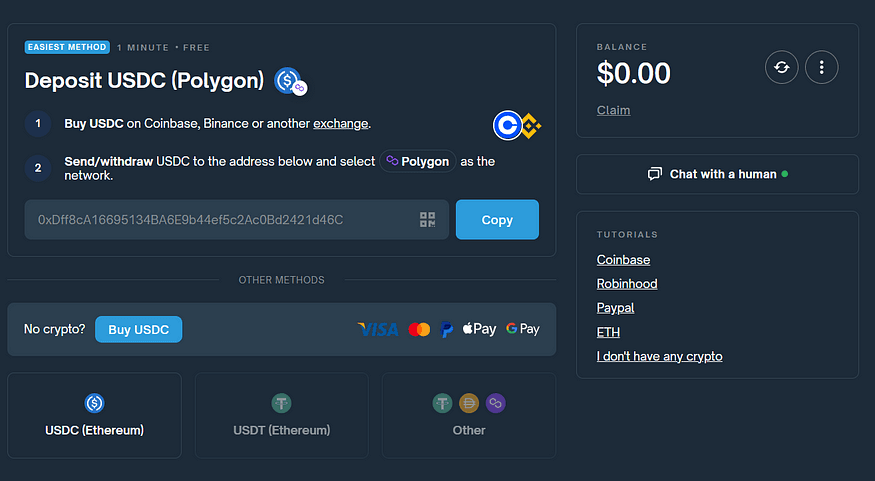

Polygon Layer-2 Integration

Scalability: Polygon’s Layer-2 solution processes transactions off-chain to increase throughput.

Cost Efficiency: Significant reduction in gas fees compared to the Ethereum mainnet.

Instant Transaction Finality: Near-instant transaction confirmation on Polygon, improving user experience.

Cross-Chain Compatibility

Interoperable Bridges: Potential to connect with other blockchains via bridges for asset transfers.

Multi-Chain Asset Support: Future-proofing for cross-chain tokens and assets.

Layer-1 Security Backing: Relies on Ethereum for ultimate security, while leveraging Layer-2 for efficiency.

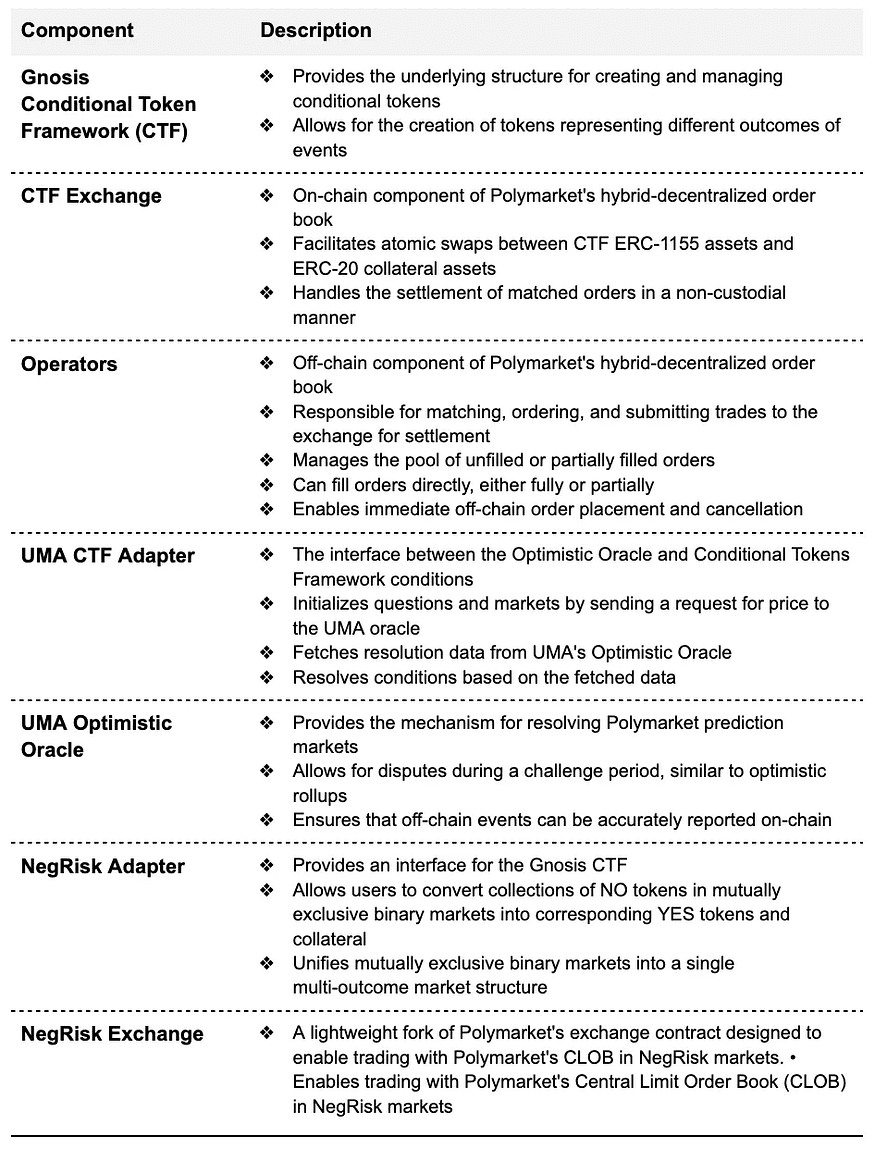

Smart Contracts

Automated Settlement

Oracles Integration: Smart contracts automatically execute based on data provided by trusted oracles.

Trustless Execution: Eliminates the need for intermediaries in market settlement.

Immutable Records: Once executed, contract results are permanently recorded on the blockchain.

Immutable Logic

Code Transparency: Smart contracts are open-source and auditable by anyone for security verification.

Security Audits: Regular third-party audits ensure the integrity of smart contract logic.

No Backdoors: Immutable code means no changes can be made post-deployment, ensuring trust.

Transparent Execution

Public Ledger: All transactions and contract executions are recorded on the public Ethereum ledger.

Verifiable History: Users can verify the entire transaction history independently.

Audit Trail: Complete traceability of every transaction and market resolution for accountability.

Order Book System

Order Aggregation

Unified Order Pool: Aggregates orders from all users into a single order book for enhanced liquidity.

Order Visibility: Users can see all pending orders in the market, providing a transparent trading environment.

Competitive Pricing: Aggregation ensures competitive pricing by balancing supply and demand.

Efficient Matching Engine

High-Speed Matching: Efficient algorithms ensure rapid matching of buy and sell orders.

Fair Execution: Orders are matched based on price-time priority, ensuring fairness.

Minimized Slippage: Reduces the difference between expected and actual trade execution prices.

Transparent Order Flow

Real-Time Order Book Access: Users can view the live order book to make informed decisions.

Full Order History: Complete visibility into past and pending orders for market analysis.

Order Flow Analytics: Tools available for analyzing order flow to identify trends and opportunities.

Core Mechanics

Market Creation

User-Initiated Markets

Event Definition: Users define specific events and outcomes for new markets.

Automated Market Setup: Smart contracts automatically handle market creation based on user input.

Diverse Market Options: Users can create markets on a wide variety of topics, from sports to politics.

Approval Mechanism

Compliance Checks: Markets are reviewed to ensure they meet platform guidelines.

Decentralized Governance: Approval can involve community voting for broader market acceptance.

Automated Filtering: The system flags inappropriate or duplicate markets for review.

Customizable Market Parameters

Duration Setting: Users can define how long the market remains open for betting.

Payout Structure: Users can choose different payout structures, such as fixed odds or proportional payouts.

Market Visibility: Options to make markets public or private, depending on user preference.

Conditional Tokens

Outcome-Dependent Tokens

Linked to Events: Tokens are directly tied to the outcome of specific real-world events.

Binary Outcomes: Tokens resolve to either full value or zero based on the event result.

Tradable Assets: Users can trade these tokens before the event resolution, allowing for speculation.

Custom Condition Setting

Multiple Conditions: Users can define complex scenarios with multiple conditions for token resolution.

Conditional Logic: Smart contracts execute based on pre-set conditional logic, automating outcomes.

Scenario Planning: Users can model various outcome scenarios to create strategic betting opportunities.

Tradable Assets

Secondary Market: Conditional tokens can be traded on secondary markets, providing liquidity.

Price Fluctuation: Prices of tokens fluctuate based on the perceived likelihood of the outcome.

Speculative Trading: Users can profit from trading tokens as market sentiment changes.

Resolution Mechanisms

Oracle Integration

Reliable Data Sources: Oracles provide trusted data to trigger smart contract executions.

Automated Updates: Oracles continuously feed data to the platform, ensuring up-to-date information.

Decentralized Oracles: Multiple data sources ensure reliability and reduce the risk of manipulation.

Synthetic Asset Support

Custom Asset Creation: Users can create synthetic assets that track real-world events or conditions.

Collateralized Assets: Synthetic assets are backed by collateral, ensuring their value.

Tradable Derivatives: These assets can be traded as derivatives, expanding market options.

Accurate Real-Time Data

Instant Data Feeds: Real-time data feeds ensure market resolutions are based on the latest information.

Error Minimization: Cross-checking between multiple data sources to prevent incorrect outcomes.

High-Frequency Updates: Frequent data updates for high-precision market resolutions.

Fixed Product Market Makers (FPMMs)

Automatic Price Adjustment

Volume-Based Pricing: Prices are adjusted automatically based on trading volume.

Liquidity Provision: FPMMs provide continuous liquidity by always quoting buy and sell prices.

Dynamic Spread Adjustment: Spreads tighten or widen automatically based on market conditions.

Continuous Liquidity Provision

Buy/Sell Flexibility: Users can always buy or sell shares regardless of other market participants.

Price Sensitivity: Prices adapt to market demand, ensuring fair value at any time.

Automated Market Depth: FPMMs maintain market depth, reducing the impact of large orders.

Fair Pricing Model

Market Sentiment Reflection: Prices reflect real-time market sentiment and participant behavior.

Reduced Manipulation: Automated pricing reduces the risk of market manipulation by large traders.

Transparent Algorithms: Pricing algorithms are publicly available and auditable for transparency.

APIs and Data Access

CLOB API

Real-Time Order Book Access

Live Data Feeds: Provides real-time data on buy and sell orders directly from the order book.

Market Depth Analysis: Developers can analyze the depth of the order book for better trading strategies.

Historical Data Access: Access to historical order book data for trend analysis.

Automated Trading Integration

Bot Development: API supports the creation of trading bots for automated market participation.

Event-Driven Execution: Bots can execute trades based on real-time market events and conditions.

Latency Minimization: High-speed API ensures minimal latency for time-sensitive trades.

High-Frequency Data Retrieval

Bulk Data Access: Retrieve large datasets quickly for backtesting and algorithmic trading.

Efficient Data Processing: Optimized for handling high-frequency trading data without bottlenecks.

Scalability: API can scale with trading volume, ensuring consistent performance.

Gamma Market APIs

Comprehensive Market Data

Detailed Market Stats: Provides detailed statistics on active and historical markets.

API Endpoints for Custom Data: Access specific market data through targeted API endpoints.

Aggregated Data Views: Combine data from multiple markets for comprehensive analysis.

Developer-Friendly Endpoints

RESTful API Design: Simple and intuitive API design for easy integration.

Well-Documented Calls: Comprehensive documentation for all API calls, with examples.

Error Handling: Built-in error handling for seamless development and integration.

Real-Time Market Monitoring

Live Market Feeds: Access to real-time market data for up-to-date analysis.

Alerting Mechanisms: Set up alerts for significant market movements or conditions.

Custom Market Tracking: Track specific markets or conditions through customized API queries.

Subgraph API

Efficient Data Indexing

GraphQL-Based Queries: Utilizes GraphQL for efficient and flexible data querying.

Indexed Blockchain Data: Indexes relevant blockchain data for quick access.

Real-Time Data Syncing: Keeps data in sync with the blockchain for up-to-date querying.

Historical Data Queries

Full Market History: Access complete historical data for any market listed on Polymarket.

Time-Based Queries: Retrieve data based on specific time frames for detailed analysis.

Custom Query Parameters: Use various parameters to narrow down data retrieval.

Custom Data Aggregation

User-Defined Filters: Filter data based on specific conditions or parameters.

Aggregate Across Markets: Combine data from multiple markets for broader insights.

Automated Report Generation: Generate reports based on predefined data aggregation rules.

Rewards and Incentives

Liquidity Rewards Program

Incentive Structures

Dynamic Reward Rates: Rewards adjust based on liquidity needs and market activity.

User Participation Metrics: Rewards are based on user contributions to market liquidity.

Program Transparency: Clear criteria and distribution mechanisms for reward programs.

Dynamic Reward Allocation

Real-Time Reward Calculation: Rewards are calculated in real-time based on ongoing market conditions.

Adjustable Incentives: Incentive levels can be adjusted to balance liquidity across markets.

Automated Payouts: Rewards are automatically distributed to eligible users.

User Engagement

Continuous Engagement: Regular incentives encourage users to stay active on the platform.

Gamification Elements: Incorporates game-like elements to increase user participation.

User Feedback Integration: User feedback is used to refine and enhance the rewards program.

Profit Opportunities

Outcome-Based Earnings

Fixed Payouts: Winning predictions pay out $1 per share.

Risk-Reward Balance: Users can balance risk by spreading bets across different outcomes.

Automated Settlements: Earnings are automatically settled upon market resolution.

Risk Management Options

Diversification: Users can mitigate risk by betting on multiple outcomes within or across markets.

Hedging Strategies: Advanced users can implement hedging strategies to protect against losses.

Probability Analysis: Tools available for analyzing event probabilities to inform betting strategies.

Real-Time Payouts

Instant Settlements: Winnings are credited instantly upon market resolution, with no delays.

Transparent Payout Calculation: Detailed breakdown of how payouts are calculated and distributed.

User Notification: Users receive instant notifications of payouts via email or in-app alerts.

Security Features

Proxy Wallets

Secure Connections

End-to-End Encryption: All communications between the wallet and Polymarket are encrypted.

SSL/TLS Protection: Uses SSL/TLS protocols for secure connections and data transfer.

Multi-Factor Authentication: Additional security layers for accessing the wallet.

Private Key Protection

Local Key Storage: Private keys are stored locally on the user’s device, never shared with Polymarket.

Key Encryption: Private keys are encrypted and protected by strong cryptographic algorithms.

Non-Interactive Signing: Transactions are signed locally without exposing the private key to the internet.

User Anonymity

No KYC Requirements: Users can participate without providing personal information, preserving anonymity.

Pseudonymous Transactions: Transactions are tied to wallet addresses, not personal identities.

Enhanced Privacy Options: Users can opt for additional privacy tools to further anonymize transactions.

Non-Custodial Design

User-Owned Funds

Full Control: Users have full control over their funds; Polymarket does not hold any user assets.

Direct Blockchain Interaction: All transactions occur directly on the blockchain without intermediaries.

Withdrawal Anytime: Users can withdraw their funds at any time without restrictions.

Direct Blockchain Interactions

Trustless Environment: All transactions are executed via smart contracts, eliminating the need for trust in a central authority.

Immutable Transactions: Once recorded on the blockchain, transactions cannot be altered or reversed.

Want to build your own Polymarket dApp? (Polymarket, Kalshi, Augur, Gnosis, and PredictIt Clone)

We can help you develop a real-world events Prediction dApp tailored to your needs.

Here’s a glimpse of the tech stack we utilize:

Blockchain — Ethereum, Polygon (Layer-2) Smart Contracts — Solidity Frontend — Next.js, Tailwind CSS (Styling) Web3 Integration — Web3.js APIs — CLOB API, Gamma Market API, Subgraph API, GraphQL Database — Datagrip (Database Management) Decentralized Storage — IPFS Wallet Integration — Metamask Oracle — UMA and Pyth

Ready to build your own Prediction Market dApp?

Contact us today.

Linkedin: https://www.linkedin.com/in/akashkumar107/

Telegram: Akash_kumar107

We’d be happy to discuss your requirements and provide further details.

Conclusion

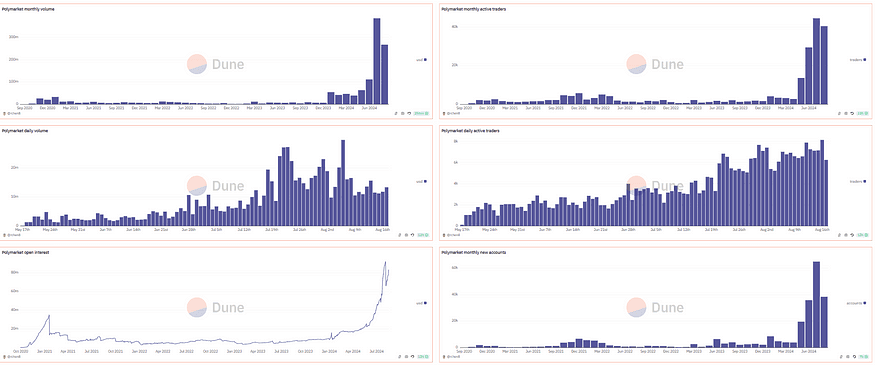

Polymarket is thriving. Despite challenges, the platform has seen record-high activity. Unlike traditional prediction markets, its unique ability to measure global public opinion across various topics is a key factor in its success.

To solidify its position, Polymarket should focus on becoming a reliable source of information, beyond just reflecting public opinion.

As regulations evolve, Polymarket is well-positioned to play a major role in predicting and preparing for future events.