From Our Blog

From Our Blog

Explaining Pump.fun: Launching and Trading Memecoins (and Building Your Pump.fun Clone)

May 1, 2024

Pump.fun has become a hotspot for creating and trading memecoins on the Solana and Blast blockchains. Launched in early 2023, it focuses on ease of use, attracting both crypto veterans and newcomers.

This article explores what Pump.fun offers, the potential benefits, pitfalls, and its place in the ever-changing world of memecoins.

Pump.fun Simplifes Memecoin Creation

Launching your own memecoin has never been easier, thanks to Pump.fun. This platform eliminates the technical hurdles typically associated with creating a new cryptocurrency.

With Pump.fun, all you need is a catchy name, a unique symbol, and an eye-catching image to get started.

This simplicity makes memecoin creation accessible to a wide range of people, from seasoned crypto enthusiasts to newcomers alike.

Key Features:

Effortless Memecoin Creation: Anyone can launch their own tradable memecoin with minimal technical knowledge.

Bonding Curve Mechanics: Instead of traditional order books, it uses a bonding curve to determine token prices. As demand increases, so does the price, rewarding early investors.

Supported Blockchains: It started with Solana and has expanded to include Blast, offering more choices for launching and trading.

Low Fees: Launching a memecoin costs less than $2, making it a budget-friendly option for experimentation.

With Pump.fun, creating, and launching your own memecoin has never been more accessible.

Whether you're an experienced developer or a curious newcomer, Pump.fun provides the tools and resources you need to bring your memecoin ideas to life.

How It Works

1. Token Creation and Trading:

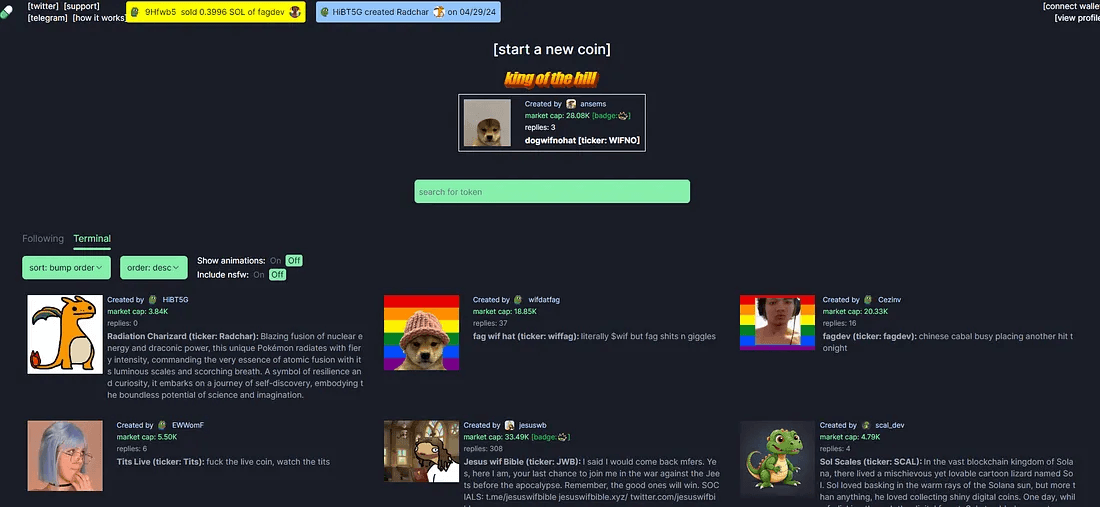

Deployers select a name, ticker symbol, and image to create tokens on Pump.fun.

Tokens become instantly available for trading on Pump.fun's platform.

Users can buy tokens directly from the bonding curve and sell them at their convenience.

2. Bonding Curve Dynamics:

Token Launch Process:

When a coin is launched on Pump.fun, 800 million tokens are put into the bonding curve.

All coins generated are identical, with a total of one billion tokens.

Sales and Bonding Curve Fulfillment:

The objective after the coin launch is to promote and sell 800 million tokens.

Once all 800 million tokens are sold, the bonding curve reaches full capacity and automatically transitions to Radium.

SOL Requirement for Radium Access:

The approximate number of SOLs required to transition to Radium is 86.

This number fluctuates slightly, typically between 84 and 86 SOL.

Market Cap Thresholds:

Approximately 45 SOL is needed to reach the "King of the Hill" status, representing a halfway point in terms of token sales.

Market cap thresholds trigger transitions in the bonding curve, with $69,000 for Solana and $420,000 for Blast.

Price Dynamics and Exponential Increase:

Token prices change exponentially based on a formula linked to the market cap.

The price per token increases significantly as the market cap grows, offering substantial returns for early investors.

Data Analysis and Curve Fitting:

Data analysis techniques, including smoothing and curve fitting, are employed to approximate the bonding curve's formula.

An exponential curve fitting formula, determined through data analysis, helps estimate token prices at different market cap levels.

AI-Assisted Data Analysis:

Advanced data analysis tools, such as Julius AI, aid in generating and analyzing charts based on collected data.

These tools provide insights into pricing trends and help in understanding the dynamics of the bonding curve.

3. Liquidity Provision and Burn Mechanism:

When a token's market capitalization hits specific thresholds ($69,000 for Solana, $420,000 for Blast), Pump.fun deposits liquidity ($12,000 for Solana, $30,000 for Blast) to decentralized exchanges (e.g., Raydium, Thruster DEX).

This liquidity injection enhances trading activity and stability.

A portion of deposited liquidity is burned, reducing token supply and potentially increasing its value.

4. Provides Alternative Launch Approach:

Pump.fun offers an alternative to traditional token launches.

It ensures fair and transparent distribution without presales or team allocations.

This minimizes rug pull risks and fosters a level playing field for all participants.

Trading on Pump.fun

There are two main ways to trade tokens:

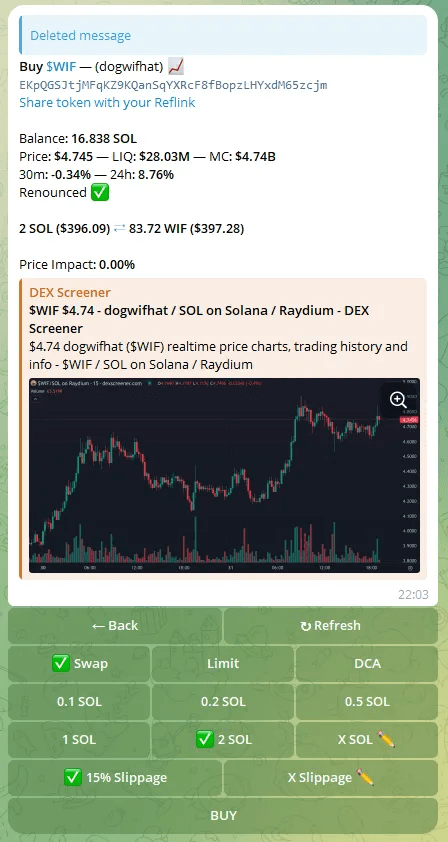

1. Using Telegram Trading Bots:

This option offers a smoother user experience, speed, and convenience. Popular bots like Trojan and Banana Gun Bot on Solana now support Pump.fun tokens.

Here's how it works:

Open the bot (e.g., Trojan) in Telegram.

Copy and paste the Pump.fun token address into the chat.

The bot allows you to trade during the bonding curve phase on Pump.fun and later on Raydium liquidity pools.

2. Trading Directly on Pump.fun:

While less convenient than bots, you can still trade on Pump.fun's platform:

Navigate to the specific token's page.

You'll see a BUY/SELL menu on the right. Enter the amount you want to buy.

Be aware of the comments section on the left. Not all comments are from buyers, and some might be misleading.

Check the "Trades" tab to see recent transactions. Pay attention to the initial purchases. A large buy right after launch could indicate a developer prepping to sell later (a "rug pull").

Recommendation:

For a better trading experience, consider using Telegram bots like Trojan. However, always do your research before using any bot.

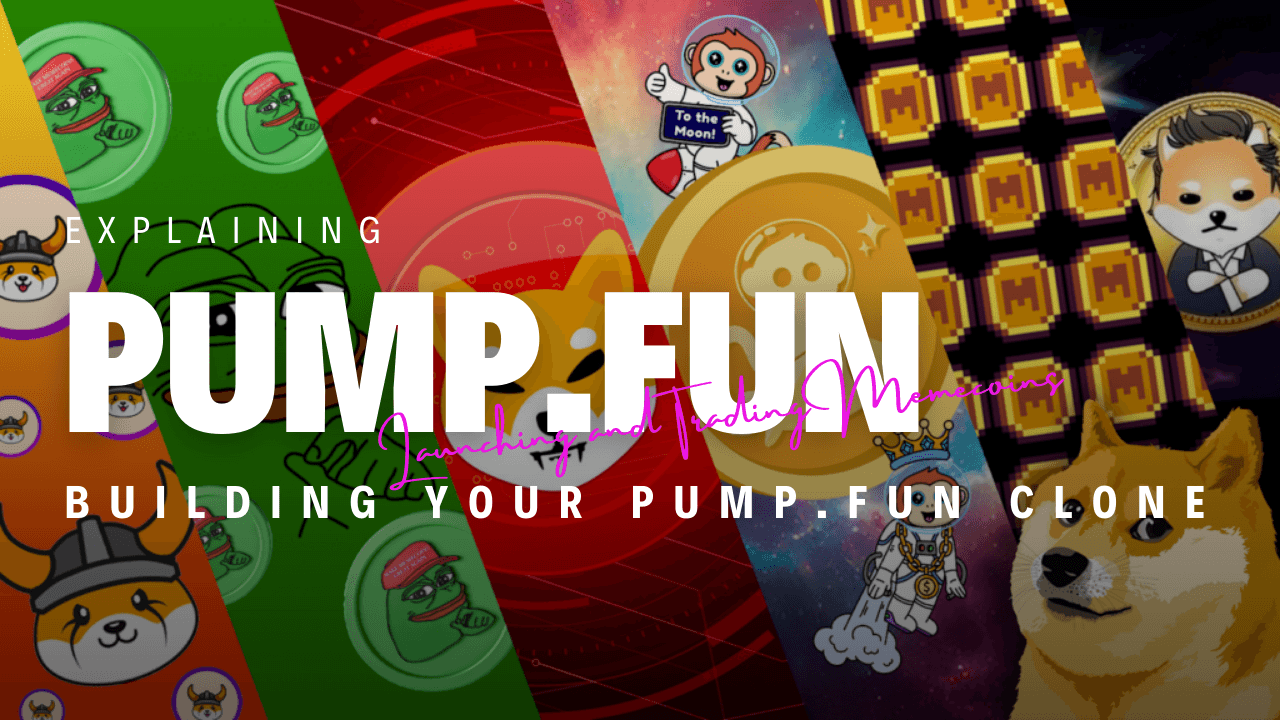

What is King of the Hill — KOTH on Pump.Fun?

King of the Hill is another expression you will see among pump.fun traders a lot. There is a spot on the top of pump website reserved for the King of the Hill.

Once a token reaches around $30K marketcap it will dethrone the current king of the hill and get displayed on the featured spot. This usually brings in new buyers but it’s also abused by scammers.

PROS and CONS

Pump.fun offers a wild ride for memecoin enthusiasts, but be prepared for the dangers lurking around every corner.

Here's a breakdown of the pros and cons:

Pros:

Early Entry: You can potentially buy tokens before they hit the mainstream on Raydium, allowing for significant profits if they gain traction.

Profit Taking: You can often take some profits on Pump.fun before the migration to Raydium, mitigating potential losses.

Cons:

Raydium Dump: There's a high chance the token will dump immediately upon reaching Raydium, leaving you with a loss if you don't time your exit perfectly.

Scam Central: Pump.fun is a breeding ground for scams due to the low barrier to entry. Expect a significant portion (around 95%) of projects to be purely for scamming investors.

Common Pump.fun Scams:

Dev Dump: Devs (project creators) might sell their own holdings before the Raydium migration, crashing the price. This can be hard to spot as it appears like regular trading activity.

Pump.fun Bundle: Devs use multiple wallets to artificially inflate the price, then dump everything before reaching Raydium. Look out for a high number of top holders with new wallets.

Big Buyer and Dump: Devs create the illusion of a large buyer to attract new investors, then dump the token shortly after. Be cautious of tokens with a single holder controlling over 10% of the supply.

Red Flags to Watch Out For:

A sudden influx of wallets buying only this specific token is a major red flag.

Research the dev's past projects. A history of dumping projects is a bad sign.

Beware of tokens with a few wallets holding a significant portion of the supply.

Reused project names, websites, or Twitter accounts scream scam.

Non-functional links are a clear indication of something fishy.

If the dev doesn't pay to update information on DEX screening sites, that's a bad sign.

Green Flags? Not So Easy

Unfortunately, identifying legitimate projects on Pump.fun is challenging. Scammers are adept at mimicking positive signals. Your best bet is to focus on red flags and exercise extreme caution.

Want to Build Pump.fun Clone?

Considering the potential of Pump.fun, you might be interested in creating a similar platform. We can help you get started quickly!

Our Advantages:

Pre-Built Solution: We've already developed and tested a robust memecoin launchpad platform, saving you significant time and resources.

Faster Deployment: Leverage our existing solution for a faster launch compared to building from scratch.

Customization Options: We can tailor the platform to your specific needs and preferences.

DEMO: https://drive.google.com/file/d/1Q4cX2ZAtYsTOEB-JLWzOUskJ36wjF3lW/view?usp=sharing

If you're interested in learning more about our pre-built memecoin launchpad solution, feel free to contact us. We'd be happy to discuss your requirements and provide further details.

Conclusion

Pump.fun offers a launchpad for the memecoin faithful, but beware – it's a playground fraught with volatility, scams, and questionable token value. Approach it with caution, do your research, and remember: invest what you can afford to lose. Only time will tell if Pump.fun can adapt, innovate, and navigate the ever-changing memecoin landscape.